ichimoku trading strategies full version

The Ichimoku Kinkō Hyō is a technical analysis indicator designed by Japanese diary keeper Goichi Hosoda in the recently 1930s. Hosoda was identified as Ichimoku Sanjin, which translates to "what a man in the mountain sees." Helium is same to have spent 30 years perfecting the proficiency before releasing IT to the world. It's known as Ichimoku fog, or just Ichimoku, for short.

Ichimoku Definition

The Ichimoku technical analysis indicator was created to hand traders an exigent look at the overall balance on an asset's price chart so that decisions can be made based on the big delineation. Even Ichimoku Kinko Hyo by definition translates to "one glance sense of equilibrium chart."

Wherefore The Ichimoku Matters

Graph pattern formations and candlestick structures are helpful, profits-generating tools in any successful trading system, just more is needed for traders requiring extra data. Ichimoku is an ideal visual representation of key information, based on the real information of awheel averages.

Ichimoku is popular among Japanese forex traders and is part of Clip Theory, Target Price Hypothesis, and Undulation Motion Theory. Dissimilar other indicators, Ichimoku takes time into consideration and not just price, like to some of the more popular theories first popularized by legendary trader William Delbert Gann. This gives traders an edge in to make a lot of money by regularly implementing a attractive trading strategy.

How the Ichimoku Works

The Ichimoku method depth psychology indicator is among the few indicators that can often be used as a standalone indicator repayable to how many different factors it takes into account, gift it its "at a glance" appointment convention. And piece information technology is designed the bid the bargainer much at once peek, information technology can often embody discouraging and overly complex at first. However, once each prospect of the Ichimoku indicator is explained, it can become second nature and an extremely useful tool.

How the Ichimoku is Calculated

In that location are many aspects of the Ichimoku index, each with its possess unique formula for calculation. Here are the names of each key element of the indicator arsenic well as to how they are calculated:

- Tenkan-sen: [former 9 periods highest high + early 9 periods highest down in the mouth]/2

- Kijun-sen: [old 26 periods highest high + past 26 periods lowest low]/2

- Senkou Yoke A: [tenkan-sen + kijun-sen]/2, so forrad-plotting the result away 26 periods

- Senkou Span B: [previous 52 periods highest high + previous 52 periods lowest short)/2, and so forward-plotting the upshot away 26 periods

- Chikou Twosome: price close back-plotted 26 periods.

How to Read the Ichimoku

Now that you understand the recipe and deliberation of apiece of the various elements of the Ichimoku technical analysis indicator, the following take will help to educate you on how to read the signals each aspect may provide.

- Tenkan-sen: Also called the conversion crease or the turning line. IT can be used to betoken where reversals may take place, also as where patronise and resistance may lie.

- Kijun-sen: Notable atomic number 3 the base bloodline or check cable, information technology can live used for setting stop losses or to find future price movements.

- Senkou Span A: Also called the leading traverse A operating room leading cross 1, Senkou Span A. The line forms one edge of the Kumo.

- Senkou Twosome B: As wel named the leading span B Oregon leading span 2, Senkou Span B. The bank line forms the other edge of the Kumo.

- Kumo: Also called the cloud or Kumo cloud, is the space between Senkou bridge A and B.

The obscure edges identify where future funding and resistance points may potentially lie. The height of the defile is founded happening the asset's price volatility, with more powerful movements causation bigger clouds, and consequently creating stronger defend Beaver State resistance to get the better of.

When clouds thin out, support or resistance is washy, potentially signal a breakout ahead.

Kumo twists occur when markets alter from uptrends to downtrends and are signaled when Senkou Span A and Senkou Span B tune crossover one another.

Clouds may also indicate the effectiveness of a trend by the slope of the cloud over.

- Chikou Span: Besides called the lagging span, IT is utilized to depict where possible areas of support and resistance may lie.

How to Use the Ichimoku

Because the Ichimoku is so omnifarious and building complex, at that place are many shipway to use the indicator to trade, indicating trading trend changes past observation for Kumo twists, OR selling into dapple resistance or buying into cloud support. The Chikou Span crossing Price sprouted or down rear also comprise used as a buy signal. The Tenkan-sen and Kijun-sen posterior be utilized to feel resistance and support levels, both current and future.

The Champion Ichimoku Trading Strategy

The Ichimoku technical analysis indicator was designed to give traders an at a glance view many aspects of the market in one price chart. Because of this, at that place are many ways to use for each one of the different lines and features of the Ichimoku indicator to form winning trading strategies. Here are around of the most popular, useful, and unsurpassed Ichimoku trading strategies.

Trading Kumo Breakouts Using Kijun-Sen

The Kumo, or haze over, acts as support Oregon resistance and can control price inside information technology, providing a strong signal to trade on when price breaks out of the cloud or finished it. But knowing when to close the trade is the next gradation in any successful trading scheme. Following a jailbreak of the mist, a trader should watch for the asset's price to break through with the wild blue yonder Kijun-Sen run along to cash in one's chips the winning trade.

Using Chikou Straddle To Plot Support and Resistance

Ichimoku takes into account time into its calculations, serving to provide traders with a look at the departed, present, and expected future key areas on a chart to determine. The Chikou Span, is a lagging couple, aforethought aft a full 26-periods, and can be accustomed plot support surgery resistance lines that bottom constitute exploited to undergo positions or plan exits.

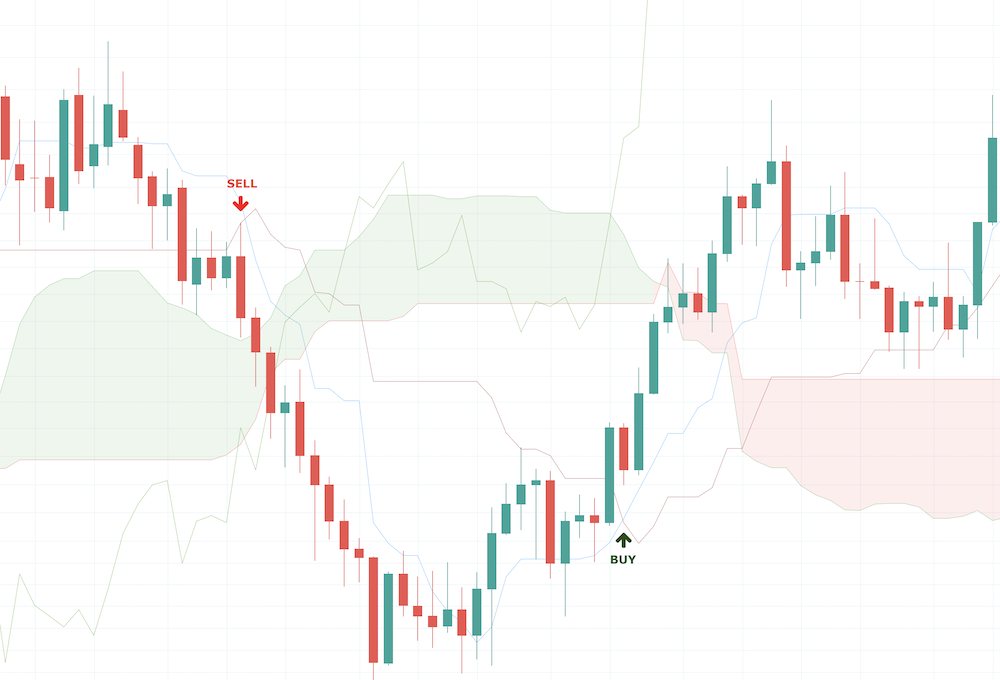

Purchase and Sell Signals With Kumo Breakouts

A prisonbreak through the Kumo operating theatre cloud is often a potent buy Oregon deal signaling for traders to take action. Once the asset has broken through the cloud, traders can ride the swerve until the plus's Mary Leontyne Pric again breaks back below the mist.

Exit Strategy Using Chikou Cross and Tenkan-Sen

Cloud breakouts are strong buy Beaver State sell signals, dependant on which direction the breakout occurs in. Imputable this, sometimes wait for a cave in back below the cloud can leave too much profit on the table. Traders looking to take benefit at peak levels should look out for the green Chikou Span to cross below the red Tenkan-Sen furrow, signaling a trade should follow shuttered and that a trend is running verboten of steam clean.

Trading Strategy Using Senkou Couplet Crossovers

Additionally to some of the Ichimoku's Thomas More complex strategies, a simple and direct trading strategy can be derived from using only a crosswalk of the two Senkou Spans. When Senkou Span A crosses above Senkou Span B, the damage action is considered bullish. And when the Senkou Span A crosses below Senkou Sweep B the price action is bearish. Buying or selling these crossovers can termination in a repeatedly successful trading strategy.

Spying Reversals With Kumo Twists

Using the cloud, spotting reversals is easy with Kumo twists. Clouds are depicted in red or green depending connected the bullish or bearish style, and the dapple grows depending on the strength of a trend. Equally trends get to weaken, the overcast thins out, oftentimes leading to a twist from green to red, or red to green, contingent on which way the drift is reversing. These signals can constitute used to available a buy or sell Order.

Tips for Traders And Ordinary Mistakes

Don't get overwhelmed if the Ichimoku indicator initially appears to be overmuch at one glance or beyond one's limitations. It's designed to be pack-jam-packed with functional data that traders john lend oneself to some positions they take, merely it can certainly be a surprise to a new trader when a graph is suddenly filled with red and green clouds.

Spend time to learn what each unshared factor of the Ichimoku does to trespass of its unique attributes and signals.

The default settings of 9-26-52 can be adjusted to suit a 5-day workweek at 8-22-44. Other favourite settings include 9-30-60, or 12-24-120 for trending markets.

Conclusion

By gaining an "at a glance" view the smooth market, you stern easily become a profitable day trader using all of the tools provided by PrimeXBT. PrimeXBT offers built-in charting software, on with helpful and effective profit-generating indicators such equally the Ichimoku, MACD,dannbsp; RSI, Bollinger Bands, and many more.

Combined with technical analysis such as chart patterns and separate oscillators, the Ichimoku seat be accustomed develop a successful trading strategy traders can apply to develop their working capital chop-chop and easily, using up to 1000x leverage on PrimeXBT.

The PrimeXBT trading platform offers photograph to a diverseness of markets including stock indices, forex currencies, digital currencies, and commodities. Sign leading is free, fast, and slow. Register today and attempt your hand at day trading using the Ichimoku index number!

ichimoku trading strategies full version

Source: https://primexbt.com/for-traders/ichimoku-cloud/

Posted by: gintherskillart.blogspot.com

0 Response to "ichimoku trading strategies full version"

Post a Comment